Any returns you make on your investment with Mercer are subject to tax. We deduct the appropriate amount from your account and pay it to Inland Revenue on your behalf (in some years you may see a tax refund).

Choosing the wrong PIR can have significant consequences, so it's best to get it right.

If you live and work in New Zealand, it's important to understand your tax residency status. Your tax residency status determines what taxes you'll pay in New Zealand, and it's important to get it right to avoid any potential issues with your PIE fund which can include KiwiSaver, Superannuation and Trust investments.

In New Zealand, you can either be classified as a New Zealand tax resident, or non-resident taxpayer. Your tax residency status is determined by a number of factors, including the amount of time you spend in New Zealand, your intentions for being in New Zealand, and your connections to the country.

It's important to note that your tax residency status can change over time. For example, if you initially come to New Zealand as a non-resident taxpayer but then decide to stay for a longer period of time, you may become a New Zealand tax resident. Similarly, if you're a New Zealand tax resident but then leave the country, you may become a non-resident taxpayer depending on your personal circumstances.

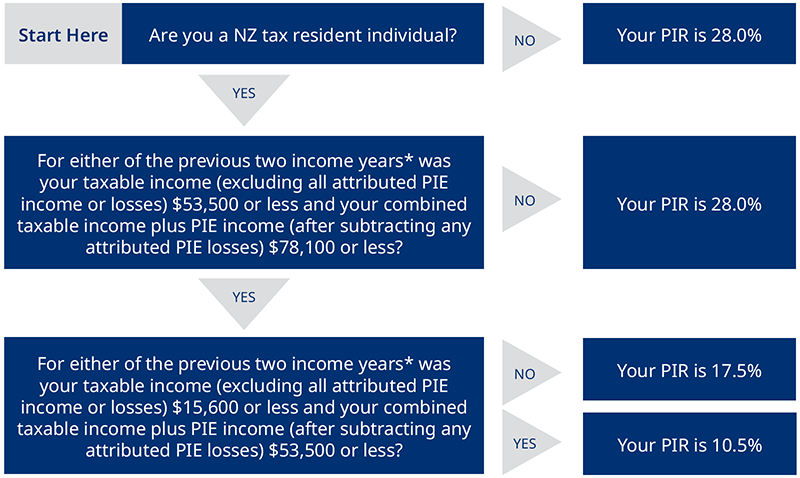

If you're a New Zealand tax resident, your PIR will be based on your taxable income for the previous two income years.

If you're a non-resident taxpayer, your PIR will be 28%. If you do not notify your PIE fund manager, your income earned from the Scheme will be taxed at the default rate of 28%.

What is the process for determining my tax residency status?

You can determine your tax residency by visiting https://www.ird.govt.nz/international-tax/individuals/tax-residency-status-for-individuals

If you're still unsure about your tax residency status in New Zealand, it's a good idea to seek professional advice from a tax expert.

How do I advise of a change in my tax residency status?

To advise a change in your tax residency status, you will need to fill in the Notification of change of tax residency status form available on your online account. To log in click here.

It's important to keep your tax residency status up to date with Mercer to ensure that you are paying the correct amount of tax and complying with New Zealand tax laws.

Additional resources

Most children in the Mercer KiwiSaver scheme will meet the criteria for the lowest PIR of 10.5%.

You can make significant savings on your child’s behalf if you update their PIR.

To check or update your PIR, log in to your account online or via Mercer NZ App.

Download App here if you don’t have it yet, it is free and with simplified access after initial login.

If you are not sure about your tax rate, you can work it out using with this PIR calculator. Alternatively, please refer to the PIR table below.

*Previous two income years refers to the two years prior to the tax year that the PIR is being applied to. An income year is generally the period from 1 April to 31 March of the following year. However, an income year can start and end on alternative dates if Inland Revenue consents. The tax year is always the period from 1 April to 31 March of the following year.

Call us on 0508 637 237. You can find more information on the Inland Revenue website.

Important: Please note that any information in this material regarding legal, accounting or tax outcomes does not constitute legal advice or an accounting or tax opinion and prior to relying and acting on this information it is important that you seek independent advice from a qualified lawyer or an accountant regarding this information.

Monday - Friday (NZST/NZDT)

Mercer NZ, PO Box 1849

Wellington, New Zealand 6140

PWC Tower, 15 Customs Street West,

Auckland, New Zealand 1010

0508 637 237

Get directions