Rays of hope for markets

As we said good bye to a difficult 2020, there are some positive signs for the global economy.

An overview of the global economy

The global economic recovery continued despite once more new COVID-19 infections reaching record levels in the US and across Europe, with new strains emerging in a number of countries.

However, as we said good bye to a difficult 2020 there are some positive signs; news of an effective vaccine rollout and certainty around the US election result are having a positive impact on markets.

Economists and analysts are predicting global markets to return to pre-COVID-19 levels in late 2021.

Infections surge stalling growth

The spike in new infections in the US is likely to slow economic growth. But President-elect Joe Biden is making preparations to transition into power and there’s an expectation that he will prioritise measures to contain the recent rise in COVID-19 infections.

Despite the spread of the virus across pockets of the US, December data pointed to signs of a recovery. There was a rise in small business confidence and home building activity, and the unemployment rate fell.

These are modest gains in comparison to China’s solid economic growth. China is expected to be the only major economy this year to see positive year-on-year growth. China’s exports rose and retail sales grew during the year. China also pushed ahead with investment in infrastructure to support new growth sectors such as artificial intelligence, robotics and 5G.

The New Zealand economy has turned a corner

Turning to the New Zealand economy, economic growth was better than expected for the third quarter, up 14% and returning to pre-COVID-19 levels and economic indicators such as consumer confidence point towards a recovery.

New Zealand continues to control coronavirus which is contributing to more confident businesses and consumers.

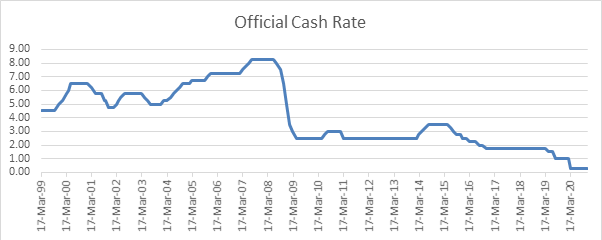

Another positive for business and investment is the record low cash rate sitting at 0.25%, down from 1.00% in February 2020. (But it’s a blow for investors reliant on interest generated from cash deposits.)

Source: RBNZ

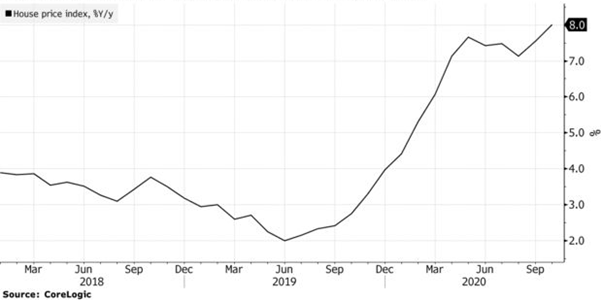

The Reserve Bank of New Zealand’s decision to cut rates is part of a $100 billion quantitative easing (bond buying) program that aims to make it cheaper for the government, businesses and households alike to borrow and invest.</p> <p>One beneficiary of low interest rates is the housing market. Low interest rates are stimulating demand for properties.</p> <p>According to CoreLogic data, home values continue to rise despite rising unemployment which was sitting at 5.3% at the end of the third quarter. As well as lagging wage growth which only rose 0.2% despite the Government raising the minimum wage from $17.70 to $18.90 an hour on 1 April during the same second quarter.

Another potential boost for residential property was the removal of the LVR restrictions in April 2020.

A mixed bag for investment markets

Global share markets finished the last calendar month of 2020 on a positive note! Despite political tension in the US and a new, highly contagious variant of COVID-19 spreading throughout the UK, global share markets continued to see inflows as investors gained comfort from the global vaccine rollout.

The Brexit transition period has officially ended and the United Kingdom and European Union have announced the Trade and Cooperation Agreement (TCA). Even with this agreement in place, many uncertainties remain for the relationship going forward. All things considered global shares returned +3.5% in local currency (+1.7% in NZD).

The New Zealand share market gained +2.6% over the month, benefitting from better than expected GDP data. This is despite the second largest company in the index, A2 Milk, experiencing a -17% loss over the month after cutting its 2021 earnings forecast. Australian shares had a positive month, returning +1.2%, bringing its one year return into positive territory for the first time since February.

The New Zealand dollar strengthened against all major overseas currencies in December except for the Australian dollar (-2.2%). In particular, it continued to strengthen against the US dollar (+2.4%), taking its one year appreciation against the greenback to +6.7%.

Outlook

While the US, Europe and other countries with high infection rates face a dark winter, economists predict brighter times are ahead—with a recovery beginning mid-2021 and spanning across a number of years.

We can expect to see governments and central banks continuing to provide support to help promote economic growth.

In a year like no other, Mercer is continuing to take advantage of investment opportunities and manage risks to deliver the best possible outcomes for members.